Licenses with Tracks & Fields GmbH

The authority resonsible here is the German tax office, called Bundeszentralamt für Steuern , here is a link to their website.

IMPORTANT UPDATE:

From January 1, 2023 on, the exemption application is to be handed in digitally. To be able to do so, you need to apply for online access. Here is the link to the site explaining it. It contains step by step instructions for registration and application.

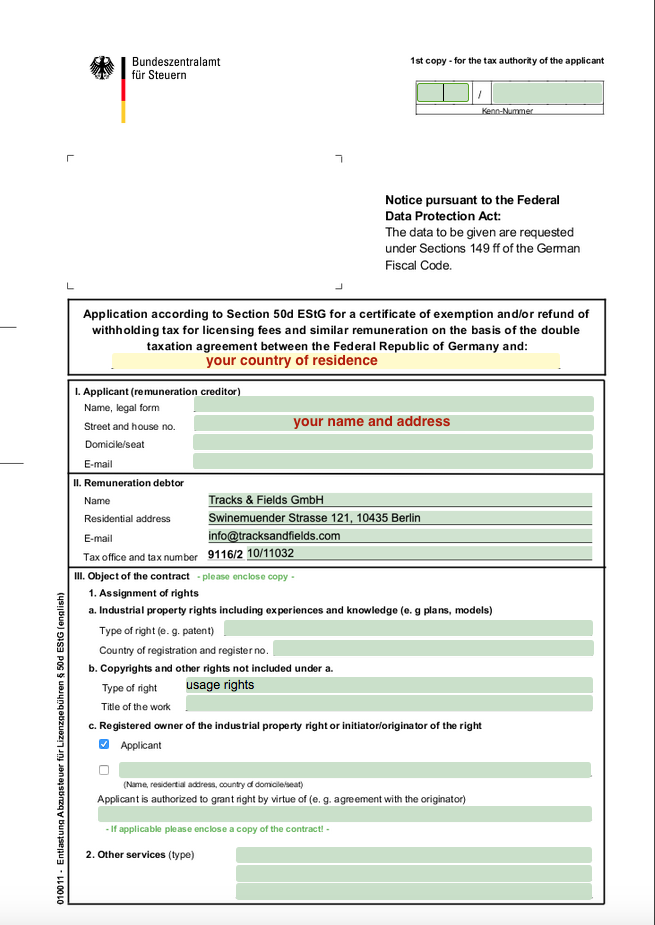

The form for the exemption looks basically like in the screenshots below. Please note, that this post is just to give a guidance how to do it, we are not updating the screenshots to match the most current version of the form, so the current form may look a bit different.

Here are the steps:

If we haven’t paid the taxes to the authority yet (as mentioned above, we have to do it quarterly), we will now wire the remainder to you and all is fine. If we already have paid the taxes then you need to get it refunded from Bundeszentralamt. To do this, we will organize a confirmation document that confirms that the license have been paid and send it to you. It will look like the form shown below.

- Once you signed a license agreement, you can start the tax exemption process. You do this by filling the tax exemption form. Please find the website containing the form here. If the link is not working anymore, you have to check on the BZST website or google for the document below. You should fill it out as hinted on the screen shots below – take over what is filled in black PLUS fill the gaps marked in red. You should fill section V and apply for exemption from the date of the license agreement (and not fill section VI) as in case it is needed, an exemption automatically converts into a refund claim (but a refund claim does not convert into an exemption).

- Send it to your local tax authority and have it stamped there.

- Once you receive it back, just send it the application to the address provided on the form. At the time of creation of this post it is:

Bundeszentralamt für Steuern

Referat St III 3

53221 Bonn

DeutschlandImportant: do not send it to us, as we are not part of the exemption process and can only disregard the document. We also don’t need a copy, as we will get notified by the German tax office once the exemption is granted (the same time you are informed by it).

- If everything is alright, you will receive a document from Bundeszentralamt. It is sent in German language (don’t know why), so the important page should look like this:

In the upper right is an internal reference number called “Geschäftszeichen”. You need to use this for all communication with Bundeszentralamt. “Die Freistellung wird erteilt” means that the exemption is granted. Further below it states the period of the granted exemption (usually a period of 3 years) which means that future licenses between you and us are also exempted from withholding taxes. We will will automatically receive a copy of this document.

IMPORTANT: There is only this one original, if you lose it there is no chance to get a second one (as the authority wants to avoid that people get refunded twice).

The document above lists the tax deduction and the social security deduction. To get the refund you need to send this doc to Bundeszentralamt (don’t forget your reference number), and state that you want a refund of the “einbehaltener und abgeführter Steuerabzug nach §50a Abs. 2 EStG” and the “einbehaltener und abgeführter Solidaritätszuschlag”. Provide your bank details (don’t forget that they need international banking information, so ideally IBAN and BIC/SWIFT, at least account number and BIC/SWIFT) and you should get the refund then.