Withholding taxes on licenses

Hi,

While we are trying to make licensing your music on Tracks & Fields as easy as possible there is an item we cannot influence – taxes on licenses.

This is not at all meant to be legal advice, the only thing we try to do is help you to understand the process of getting the tax back or getting an exemption from the tax payment.

What is withholding tax ?

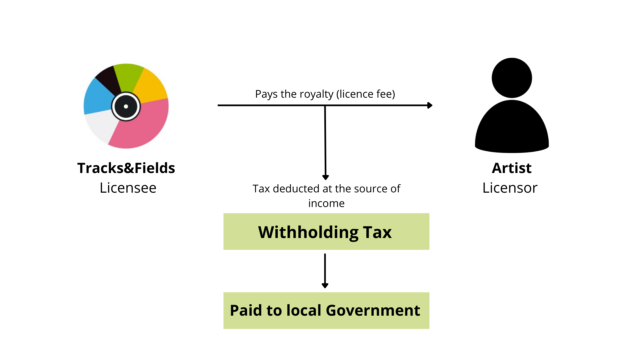

It is a tax on certain types of income, e.g. interest or – as in the case of music licenses – royalties (which are payments for granting a license). The way withholding tax works is that the debtor of the payment (Tracks & Fields) has to directly deduct the tax amount from the payment and pay it to the tax office – unless you have an exemption (and this is what this post is about).

Tracks & Fields as the company licensing music from you has to deduct the tax from the license payment (we are simply obliged to do so by law unless you have an exemption). Please note,

Please note that this tax is not VAT.

While invoices to foreign countries typically have a VAT rate of 0%, the tax that applies here is withholding tax which applies on license fee payments, (and also any other royalties, interest etc.), not VAT.

Upfront: Alternative way of handling withholding tax

Before explaining the exemption process we want to inform you that – instead of exemption – in various countries you can also include these deducted taxes in your annual tax declaration (as “foreign taxes paid”). That way the paid foreign taxes are credited against your local tax obligation. You need to check with your tax accountant if this process is applicable to you. If you opt for this, the tax is withheld at first, we will send you a confirmation of the amount of taxes withheld (after declaration which is after the end of the quarter we paid you) and you can use this confirmation in your annual tax declaration.

Exemption?

In most cases, due to bilateral tax treaties, the tax burden with an exemption is reduced to 0%.

Also, once you have the exemption, it applies to future licenses with us until the exemption expires – so you don’t need to do that process every time.

Last, but not least: with an exemption you can also claim back taxes that have been withheld by us before. This has limitations as well (depending on the regulations of each country), but for the previous 1-3 years it is usually possible.

The tax exemption is a bureaucratic procedure, but all in all easy to manage.

Start the process as soon as possible

Double taxation treaties don’t apply automatically. Just checking that the double taxation tax treaty between your country and e.g. UK provide a 0% tax rate does not mean that taxes do not need to be withheld. Such treaties apply to taxpayers in country A and B. Thus, the general idea of the tax exemption process is to prove that you are a tax payer in one country and therefore the tax treaty applies.

We recommend starting the exemption process, once you sign a license agreement as it influences the re-claim and payment of the withholding tax itself.

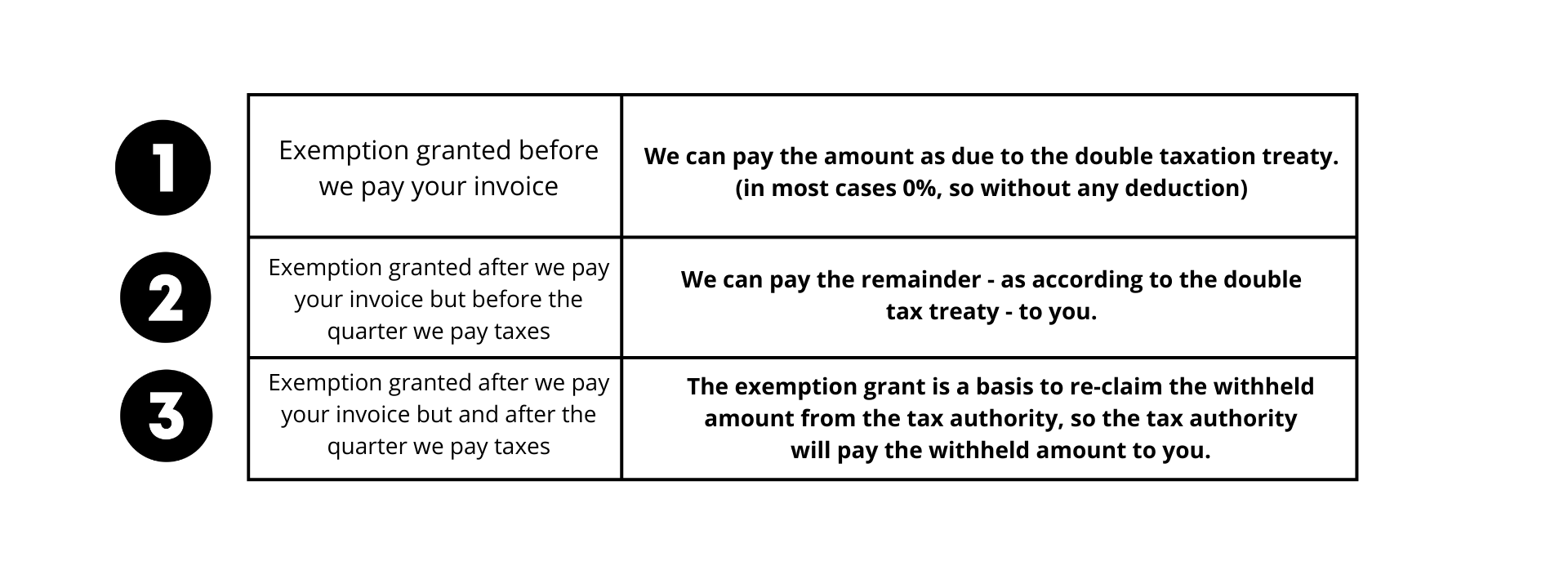

We pay the withholding tax on a quarterly basis to the tax authority, which basically creates 3 possible cases:

As it is your tax duty, we are – apart from withholding, declaring and paying it on your behalf – not part of the exemption process. We will be just automatically informed once the exemption is granted. That’s the reason why you should never send the exemption documents to us, as we can not do anything with these. Also, we won’t have any information about the status of your exemption, as this is something between you and the tax office. For any requests related to the exemption, you need to directly deal with the tax authority.

Don’t assume that the tax process is the same as your home country

If you, e.g. are located in the US, the typical way to get US tax exemption is through forms like W-8BEN. But this would be the process for the US, if you are receiving royalties/license fees from other countries, their process applies.

Literally every country has withholding tax, but every country has a different process of how to get exempted and/or get the withheld tax back.

We are now explaining the processes for the UK and Germany in this post (UK and Germany are our 2 addresses at the origin of our contracts and will therefore determine the country to which you will have to apply for exemption)