Your song has been placed – what’s next?

Congrats, your song has been placed!

To make most out of your placement and also have the further process running as smooth as possible, we collected some information in this short post.

PR & Marketing

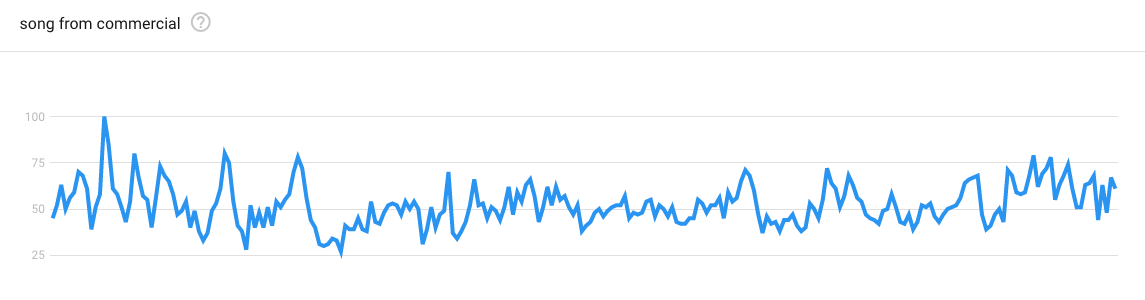

People often discover new artists through advertising, TV shows and feature films. Terms like “song from commercial” have a constantly high interest on Google.

Have your social media up to date and running

To gain new fans, have your social media presence up and running. Remember, people were actively searching for the song and artists, so, once they found it, you should welcome them with open arms to increase your fan base.

Make your song available for stream and download in the countries of the license

It seems to be obvious, as this means extra money for the artists. However, lots of times artists don’t check if their potential new fans can actually listen to and buy the song. So, please make sure it is available particularly in the territory of the license.

Organisation & Processes

Provide a proper invoice with banking details

Tracks & Fields is paying licenses based on receiving an invoice. The invoice should state your address, our address, the license (or services) it refers to, the amount, a date and and invoice number.

As we do all license payment through wire transfer you need to include also your banking details. We are wiring through a local bank account in most of the cases, so e.g. in US we need an ACH routing number, an account number and the name of the account holder. For European Union this would be the IBAN and the account holder name. Put your banking details directly on the invoice to make sure payment is running smoothly. We did a separate post about his here.

Withholding taxes

In every country in the world there are withholding taxes applying on license fee payments (note, this is not VAT). This is a tax you owe to the country you receive monies from, but we are obliged to directly deduct and pay it on your behalf. The good news is, most countries have signed double taxation treaties to avoid those taxes. In order to be eligible to benefit from the double taxation treaty you have to prove that you are a taxpayer in your country. While the principle is the same, the process differs in each country. Tracks & Fields has offices in Germany in UK, so depending on which office you are licensing to, you have to either follow the exemption procedure of UK or Germany. We did a post giving you an explanation here. Please always use the most up to date forms and start the exemption process right away.

Business practices in certain countries

Some countries have very strict rules about sending money abroad or require a compley transfer setup in order to pay bills.

In China, for example, foreign transfers are typically only possible once a month, as they involve a complex approval process. In addition, they require an intermediary bank through which transfers are being directed. Both combined can lead to payment cycles up to 6 months. Similar hurdles exist in other countries (e.g. Brasil).

That being said, while we always strive to receive the money in time and as soon as possible, there could be regulatory or fiscal barriers for clients to make payments, which could lead to a delay in payment beyond the avaerage payment term we include in our licensing agreements. Please be prepared (or prepare your artists) for this possibility.