Licenses with Tracks & Fields UK Limited

The process for making a claim under a double taxation agreement is quite straightforward for licenses made with Tracks & Fields UK Limited.

The responsible tax authority for UK is HMRC.

You can check for detailed information on the HMRC website here or jump to the relief for companies here. Basically there is one form to be filled for double taxation treaty relief, depending on whether you as the receiver of the license fee are an individual or a company. Please note, that this post is just a guidance how to do it, we are not updating the links and the screenshots, so make sure you are using the current version of the form. Also, the links below guide you to the general forms, there are also specific forms for some countries (e.g. US), which you can check out here.

I am an individual

Form DT individual

I am a company

Form DT company

The forms look extensive at first sight, but half of the pages is information on how to fill it + it contains sections for exemptions on interest as well (which is not relevant here).

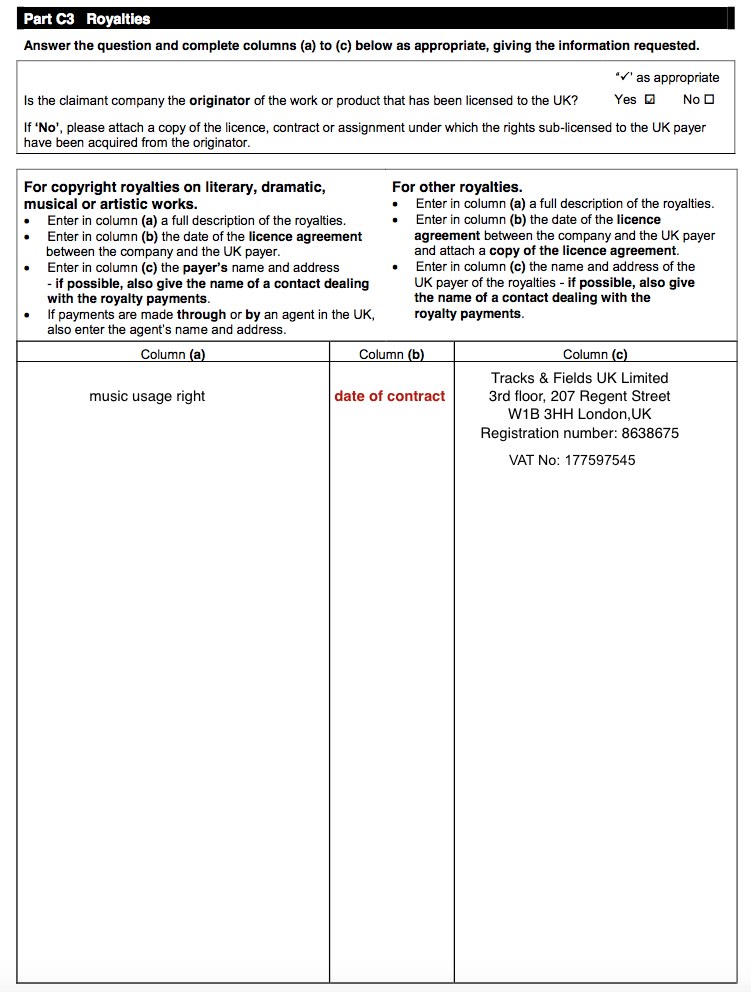

The screenshot below shows the parts with the information of Tracks & Fields UK Limited (name, address, registration number), which apply to both of the forms:

There is also a section where your local tax office confirms that you are taxpayer in your country. Follow the instructions as detailed on the form.

Where to send the form to

The address is stated on top of the form, at the time of creation of this article it is

For companies: Large Business – DTT Team, HM Revenue and Customs, England BX9 1QR

For individuals: HM Revenue & Customs, Pay As You Earn and Self Assessment, BX9 1AS

Important: do not send it to us, as we are not part of the exemption process and can only disregard the document. We also don’t need a copy, as we get notified by the UK tax office once the exemption is granted (the same time you are informed by it).